December 2014

|

Strong administrative structure must precede GST implementation

|

|

GST and India’s Competitiveness

|

|

Centre promied to clear CST dues starting next year: AP finance minster Yanamala Ramakrishnudu

|

|

ICAI northern chapter hosts seminar on GST

|

|

Expect GST to have a positive impact on port companies: Sudip Bandyopadhyay

|

|

Basic exemption limit in taxation may be hiked in Budget 2015

|

|

GST woes: States differ with Centre

|

|

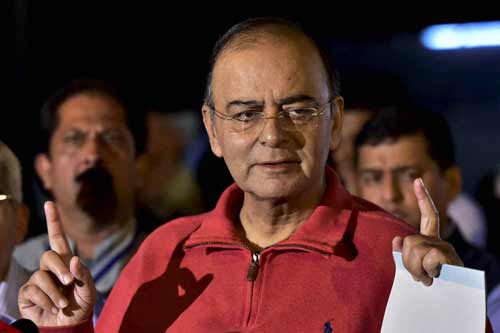

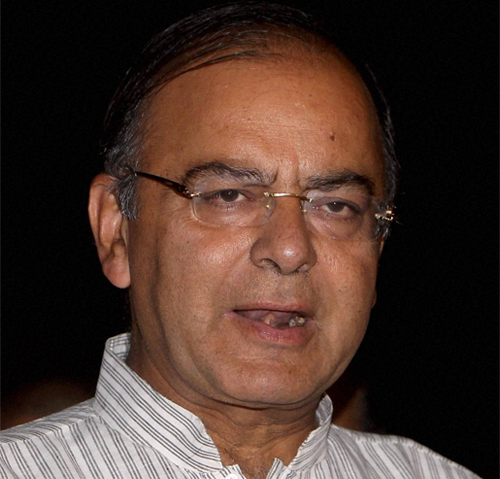

Jaitly to discuss pre-budget consultation with state FMs

|

|

GST will score over existing regime in transportation and logistics industry

|

|

|

|

Common man to benefit from GST; states to gain from Day 1: Finance Minister Arun Jaitley

|

|

GST - Central Government to offer compensation to state

|

|

Goods and Services Tax: How neutral is the revenue neutral rate ?

|

|

GST - simplify and harmonies the indirect tax regime in the country

|

|

India’s GST Bill makes its way to Parliament

|

|

Civic administration is expecting the funds from the state and the Centre after GST implementation

|

|

Didi for GST, but opposes some clauses

|

|

Centre rushes bill on GST, may go for ordinance on insurance

|

|

Evolve consensus before introducing Constitutional Amendment Bill on GST, Tamil Nadu CM tells Modi

|

|

States not consulted over proposed amendments to GST Bill: Amit Mitra

|

|

Automobile, logistics companies to reap rich GST dividend

|

|

GST bill is approved in Union Cabinet

|

|

Finance Ministry may move formal GST proposal in next cabinet meeting

|

|

GST constitutional amendment bill to be tabled in current session

|

|

Government readies to get states back GST: Arun Jaitley to meet state finance ministers

|

|

States set to reveal their mind on petroleum GST

|

|

Centre to release Rs 11,000 cr CST compensation to states: Arun Jaitley

|

|

GST to be implemented from April 2016: Sinha

|

|

Area-based excise sops to continue under GST

|

|

CST compensation partly before Budget

|

|

Odisha to pitch for green cess in GST meet

|

|

Rationalizing subsidies, GST, taxes: Jaitley explains Modi's reform plans

|

|

FM dangles Rs 13k-cr carrot to clear GST bottlenecks

|

|

States may get power to tinker with ‘State GST’ rates

|

|

Making the entire country an SEZ - GST will help

|

|

Important issues – GST and its implementation

|

|

State wants Petrol kept out of GST list

|

|

TARC recommends government bring back fringe benefit tax

|

|

Assam in favour of GST, but wants petro products out

|

|

CEA to hold 'North Block Policy Charcha'

|

|

GST Bill- introduce in current Parliament session by the cabinet

|

November 2014

|

Maharashtra seeks Rs 4,500 crore in drought aid from from Centre

|

|

GST is a broad issue according to Arun Jaitley

|

|

Government to introduce GST Bill in current Parliament session: Arun Jaitley

|

|

Centre, States will negotiate on broad contours of GST Bill early next month

|

|

Maharashtra govt bats for 5-year GST compensation period

|

|

Determined BJP seeks to table insurance, GST Bills

|

|

Won't let Land Act provisions dilute: Kamal Nath

|

|

Government hopeful of passing GST bill in current Parliament's Winter session: MoS Jayant Sinha

|

|

GST may subsume all entry taxes

|

|

GST- the single most important tax reform in India

|

|

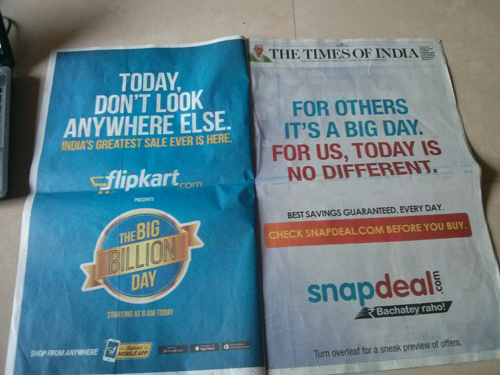

GST to take care of many of e-commerce firms’ tax issues: IT minister

|

|

The scrapping of LBT is furnished until GST is introduced in Maharashtra

|

|

Logistics companies looking for funds to build scale & be GST-ready

|

|

Government hopes smooth Parliament session on GST

|

|

GST can make positive changes in economy and equity - Citigroup

|

|

GST-proposed as a part of new aviation policy

|

|

To push the GST bill in winter season

|

|

Centre wants a fresh look on low GST threshold

|

|

GST issues: Still no consensus between Central government, states

|

|

As GST looms, Tamil Nadu looks at ways to keep kitty intact

|

|

Panel moots stiff 27% revenue-neutral Goods and Service Tax

|

|

Punjab protests to Gujarat’s proposal in GST meeting

|

|

Jayant Sinha - expecting growth post implementation of GST

|

|

Jaitley plans to act on GST, land acquisition and insurance bill

|

|

Amending land purchase law priority for government: Arun Jaitley

|

|

Government in final stages of discussions with states on GST: FM Arun Jaitley

|

|

Final talks on with states on Goods and Services Tax: Jaitley

|

|

|

|

Expect big bang reforms in Budget; MAT reduced: Adi Godrej

|

|

Congress may back government on GST, coal ordinance

|

|

|

|

Congress supporting Modi on GST movement

|

|

India Opposition Signals Support for Key Modi Reforms

|

October 2014

|

|

|

GST implementation will create a remarkable development in manufacturing industry – World Bank

|

|

Tax Regime under GST should not be aggressive-FICCI

|

|

Government to introduce constitution amendment bill to initiate GST-in the winter session

|

|

Revised GST Bill in Winter Session: Arun Jaitley

|

|

Government sets deadline of six months for rolling out Direct Tax Code and GST

|

|

BJP needs non-NDA support for bill amendment on GST in Rajya Sabha

|

|

Nirmala Sitharaman- Closer to a solution on the GST

|

|

Poll results give BJP half the economic pie

|

|

Goods & Services Tax, insurance next on Modi Government’s reform agenda

|

|

State Coffers Bleed Tax as Booming E-tail Deepens Cut

|

|

Satya Poddar: Cleaning up with the GST

|

|

|

|

Market of Maharashtra is waiting for the election result

|

|

Achhe Din ? Maharashtra win or loss will define Modi's economic gameplan

|

|

Government must focus on reforms soon, like autos: Ambit Cap

|

|

CEAMA agrees Government's involvement on etailing cos' pricing

|

|

Centre plans to give 3 years GST compensation for states

|

|

Government may have to put GST plans on hold

|

|

Zero-rating GST on petro products – A thoughtful response to the state’s demand

|

|

Appointments of CEA wait till Jaitley’s recovery from bypass surgery

|

|

Centre rejects Gujarat’s proposal of retaining 2% of integrated GST

|

|

Modi Government rejects states’ demand

|

|

|

|

World Bank presses for reforms

|

|

The economy is reviving, foreign investors are favouring India: Nirmala Sitaraman

|

|

World Bank expects India GDP growth to accelerate to 5.6% in Financial Year 2015

|

|

Demand of states accepted partially in the revised GST bill

|

|

Modi Government to take further initiative on GST implementation

|

|

|

September 2014

|

Centre keen on implementing GST soon, says Minister

|

|

GST should treat like Center State issue not like ordinary economic efficiency issue

|

|

Raman Singh shows Positive view to GST

|

|

GST will make India One Market, says Mukhesh Ambani

|

|

Finance Commission recommends for higher devolution

|

|

Modi’s ‘Make in India’ plan: The 7 hurdles it needs to overcome to boost manufacturing

|

|

Service taxes set to get a big infrastructure bump

|

|

Madhya Pradesh CM to cast his vote in favour of GST

|

|

‘Partnership with United Spirits has transformed Diageo’s position in India’

|

|

Finance Commission can look into GST compensation issue: Sumit Bose

|

|

GST implementation from April 2016 feasible: Revenue Secretary Shakti Kanta Das

|

|

The State Finance Ministers are still consulting on GST format

|

|

Government to introduce Constitutional Bill, with petroleum products in ambit

|

|

Slow growth in tax revenue at the core of fiscal crisis

|

|

Five point plan to jumpstart economy by Modi Government

|

|

Telangana pins hope on 14th finance panel report

|

|

Compensating the state – submitted proposal from Gujarat

|

|

E-commerce operators - easy compliance on GST

|

|

Gujarat suggests unconventional way out of GST deadlock

|

|

Jaya Flags Concerns Over Roll-out of GST

|

|

Petrol products should be out of GST: Jaya

|

|

Probability of GST implementation on April 2016

|

|

Meeting at Tirupati can take a positive turn in GST application

|

|

Shivaji Singh Chouhan gives an affirmative view on GST applicability

|

|

Before GST application AP seeks compensation

|

|

Modi to take further approach for implementing GST

|

|

|

August 2014

|

Thumbs up for Modi by India Inc

|

|

Macquarie has awarded the UPA government 8.5 out of 10 for celebrating 100 days in power

|

|

Arun Jaitly and Mamata Banerjee meeting regarding GST had a successful turn

|

|

GST: indirect tax regime to focus on unified framework

|

|

Revenue loss still holds a barrier for GST implementation

|

|

GST movement goes further but fails to get required support from states

|

|

Threshold limit for levying GST reduced to Rs 10 lakhs

|

|

GST to go ahead: Compensation proposed to be offered in three consecutive years

|

|

Gujarat proposal may pose hurdle to Centre’s GST rollout

|

|

Jayalalithaa addresses GST issues & seeks compensation for revenue losses

|

|

Centre to give states Rs 25k cr to help push GST

|

July 2014

|

GST row: Uttar Pradesh on board, MP and Rajasthan differ

|

|

GST: Centre expects consensus soon, Bill likely in Winter Session

|

|

Compensation Sought for CST Loss

|

|

NDA to put GST on fast track: Arun Jaitley

|

|

GST will work well for all: Experts

|

|

Govt. to resolve issues hampering GST roll out within this year

|

|

Budget lacks focus in crucial areas: Naveen Patnaik

|

June 2014

|

Commerce Minister Nirmala Sitharaman to implement GST soon

|

|

GST: Centre's task easier with poll shift

|

|

GST Implementation to Help Narrow Fiscal Deficit: Crisil

|

|

FHRAI asks govt to rationalise taxes in hospitality sector

|

|

CII seeks GST implementation, export incentives

|