State Coffers Bleed Tax as Booming E-tail Deepens Cut

Dated 18th October, 2014

The booming business gained by e-tailers including Flipkart, Myntra, Snapdeal and Amazon from net savvy Kerala customers is creating a huge dent in the already-strained coffers of the state as the tax on the goods sold here is collected in states like Karnataka and Tamil Nadu where the products originate.

The booming business gained by e-tailers including Flipkart, Myntra, Snapdeal and Amazon from net savvy Kerala customers is creating a huge dent in the already-strained coffers of the state as the tax on the goods sold here is collected in states like Karnataka and Tamil Nadu where the products originate.

Kerala, a consumer-centric state, would not earn a single rupee from the online transactions as long as the products are coming from outside the state. Value Added Tax or VAT is charged in the state, where the goods originate. With e-commerce expected to grow multifold in coming years, the state would be a big loser as far as tax revenues are concerned.

“I’ve asked the Tax Secretary to submit a comprehensive report on e-commerce business from the state and how we could tap this segment for revenue generation,” a worried Finance Minister K M Mani told ‘Express’. Mani said he expected the report to be submitted in two weeks.

Though there are no official figures, traders estimate the ecommerce transactions in the state to have doubled from Rs 10 crore a day in 2012 to Rs 20 crore per day now, which translates into about Rs 600 crore per month.

The only hope for Kerala to get revenue from e-commerce transactions is the implementation of the Goods and Services Tax (GST), expected in 2016, said Gopakumar V J, deputy commissioner (general), commissionerate of commercial taxes, Kerala.

Under the GST, the tax regime would change from the current origin-based tax to destination-based tax structure, benefiting consumer-centric states like Kerala, said the tax official. However, it remains to be seen if manufacturing-based states such as Gujarat, Maharashtra, Haryana and others would allow this without getting their pound of flesh.

With Prime Minister Narendra Modi asking states to promote manufacturing under the ‘Make in India’ campaign, it would be unrealistic to hope that the Centre would agree to a destination-based tax regime at the cost of product manufacturing states.

In the past, Kerala tried to impose an entry tax to garner revenues for goods coming from outside the state.

However, the Kerala High Court, in a 2006 ruling, said the demand and collection of entry tax is “illegal, unauthorised and violative” of Article 301 of the Constitution.

In online purchases originating from the state too, the Kerala Government tried to collect tax on ‘cash-on-delivery’ transactions arguing that these transactions are subject to VAT, even though the movement of goods may have commenced from outside the state. However, this has forced Flipkart and Amazon to stop cash-on-delivery transactions to Kerala.

Binny Emmatty, state president of the Vyapari Vyavasayi Samithi, said the traders in the state are losing out as e-commerce outfits are exploiting the tax advantage to provide heavy discounts. He said there was no recourse for customers if the products offered by e-tailers turned out to be faulty.

A spokesman for Amazon said: “We are an online marketplace and our sellers determine the prices. Sellers are also contractually obligated to list genuine products with manufacturer warranty. This applies to all brands. Further more, we also extend 100 percent customer protection with Amazon’s A-to-Z Guarantee for all products bought on Amazon.in.”

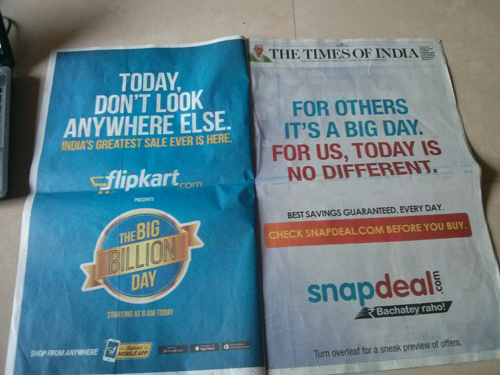

Flipkart and Myntra did not comment while Snapdeal could not be reached. Industry officials pointed out that Flipkart sold about 25,000 televisions and 500,000 mobile phones on the ‘Big Billion Day’ and their sales were more than Rs 600 crore. On the same day, Amazon touched their highest ever sales and Snapdeal sales went up by 15 times. It is reckoned at least 10 per cent of these sales originated from Kerala. Jose Sebastian, associate professor at Gulati Institute of Finance and Taxation, however, felt e-commerce would not be a major threat to the government finances as only upwardly mobile consumers use the online platform.

“Even without e-commerce, there is a massive tax evasion in the state. For instance, we are the number one state in terms of per capita consumer expenditure. However, we are only number eighth in terms of per capita VAT collection as a percentage of per capital consumer expenditure,” the associate professor at Gulati Institute of Finance and Taxation said.

(This article was covered on Oct 18, 2014 in The New Indian Express)