GST rates: Here’s why proper fitment of products based on actual tax is pivotal

Dated 25th April, 2017

With GST to be rolled out soon, the GST Council is all set to decide item-wise rates in May for goods and services based on the Harmonised System of Nomenclature (HSN) and Service Accounting Codes (SAC). While the four-tier rate structure of 5%, 12%, 18% and 28% has been finalised by the GST Council for levy of taxes on goods, it is expected that GST rates for bulk of goods will be at standard rates of 12% and 18%, essential commodities could be taxed at a lower rate of 5%, while luxury goods will be taxed at the higher rate of 28%. Additionally, a compensation cess on ‘sin’ goods—such as luxury cars, tobacco products, pan masala and aerated drinks—is proposed to be levied.

With GST to be rolled out soon, the GST Council is all set to decide item-wise rates in May for goods and services based on the Harmonised System of Nomenclature (HSN) and Service Accounting Codes (SAC). While the four-tier rate structure of 5%, 12%, 18% and 28% has been finalised by the GST Council for levy of taxes on goods, it is expected that GST rates for bulk of goods will be at standard rates of 12% and 18%, essential commodities could be taxed at a lower rate of 5%, while luxury goods will be taxed at the higher rate of 28%. Additionally, a compensation cess on ‘sin’ goods—such as luxury cars, tobacco products, pan masala and aerated drinks—is proposed to be levied.

The industry is keenly awaiting the rate schedules for goods they manufacture/deal with, so that tax implications can be calculated. The view of the government—gathered from public domain—is that goods will bear the same tax incidence in GST as is their current tax incidence. This is easier said than done. If the government’s intentions are to be operationalised, it is imperative to understand the correct tax incidence of products in the current tax regime.

At present, many products are subject to an excise duty of 12.5% and VAT of 14%. A simple addition of these two takes the current tax incidence to 26.5%, and accordingly these goods may get classified under 28% rate in GST. However, fitment of goods into the higher rate of 28% by summing up the prima facie excise rate and VAT rates may result in arriving at distorted rates for GST.

The real current tax incidence may be fairly lower than the apparent tax incidence for reasons such as lower excise rates prescribed by exemption notifications on various products. Importantly, the same goods may be subject to different rates of VAT in different states. Now, so as to arrive at the real state tax incidence, a weighted average of state VAT across the country may need to be considered.

Further, excise duty is levied on the ex-factory price of the product. Post-manufacturing value additions such as marketing costs and post-removal transportation costs are not leviable to excise duty. Where excise duty is applicable on the MRP value of products such as mobile phones, refrigerators, soaps, biscuits, etc, abatements of up to 45% are provided to exclude such post-manufacturing value additions from the levy of excise duty.

However, under the GST regime, tax would apply on the transaction value of the product. Therefore, the correct excise incidence would be the actual excise duty paid, expressed as a percentage of the final price. For example, if ex-factory price of a product is Rs 100 and its final price is Rs 150, then even though the nominal excise rate may be 12.5%, the actual excise incidence would be only 8% considering the value base (100×12.5%)/150.

Additionally, on account of excise duty exemption to small-scale industries, the unorganised sector currently does not pay excise duty where the turnover of the manufacturers does not exceed the annual turnover threshold limit of Rs 1.5 crore. The CENVAT credit which they lose is insignificant in most of the cases as they too procure from the unorganised sector. Therefore, these unorganised players comprising of SME manufacturers may have nil or minimal excise incidence and may only be subjected to VAT on final products. Let alone levying GST at 28%, levy of tax at 18% itself may be excessive in such cases. Fixing GST rates above the real tax incidence would negatively impact the industry.

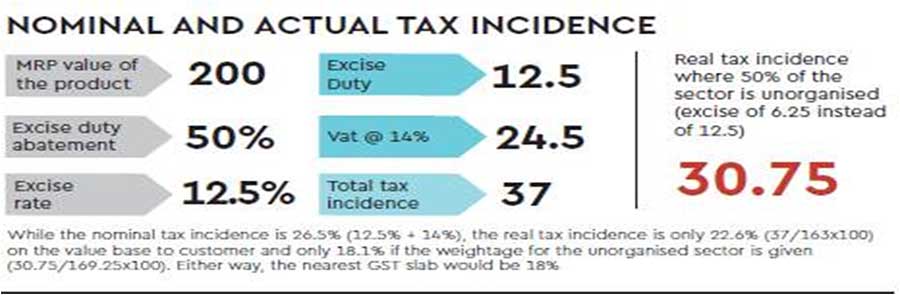

The increase in the number of registered assessees in the GST regime on account of lower threshold limit of Rs 20 lakh, compared to the current threshold of Rs 1.5 crore for applicability of excise duty, also needs to be factored for determining the rates. The accompanying table indicates the nominal tax incidence and actual tax incidence considering the above factors, based on illustrative prices, tax rates and abatements.

In this example, it can be noticed that while the nominal tax incidence is 26.5% (12.5% + 14%), the real tax incidence is only 22.6% (37/163×100) on the value base to customer and only 18.1% if the weightage for the unorganised sector is given (30.75/169.25×100). Either way, the nearest GST slab would be 18%.

Tax rate being one of the factors contributing to price changes, post implementation of GST, a proper fitment of products based on the actual current tax incidence is pivotal. Amongst other aspects, several manufacturers of mobile phones, industrial products and automobiles have set up or are looking to set up manufacturing facilities in India. The government has twin objectives of encouraging Make-in-India and ensuring that there is no inflationary tendency, post GST.

To achieve that, it is necessary to fix the GST rates considering the practical issues discussed above. Since GST rates for imports as well as indigenous goods are likely to be akin, all eyes are set for the release of final GST rates of finished goods.

Source: www.financialexpress.com