Revenue neutral rate for GST: Panel to submit RNR report to Empowered Committee

Dated 19th November, 2015

A committee mandated with deciding the crucial revenue neutral rate (RNR) for the proposed rollout of the Goods and Services Tax (GST) regime is likely to submit its report before Friday’s meeting of the Empowered Committee of State Finance Ministers, two finance ministry officials said.

A committee mandated with deciding the crucial revenue neutral rate (RNR) for the proposed rollout of the Goods and Services Tax (GST) regime is likely to submit its report before Friday’s meeting of the Empowered Committee of State Finance Ministers, two finance ministry officials said.

The panel, headed by Chief Economic Adviser Arvind Subramanian, was set up in June this year to prescribe a RNR which strikes a balance so that the rate isn’t too high for industry and simultaneously high enough, so that states do not suffer any revenue loss.

The RNR report will subsequently be taken up by the Empowered Committee for consideration. Apart from the revenue neutral rate, the committee will suggest the impact of GST rollout on inflation, one of the officials said, adding that the panel will also define the methodology for compensating states for revenue loss on account of GST rollout.

“Though the compensation rate had been decided earlier, the methodology for assessment of revenue loss has not been decided so far. The CEA panel is looking at suggesting a mechanism for calculation of the possible revenue loss when GST comes into effect,” the official said.

Subramanian is also likely to present his view regarding the imposition of 1 per cent additional levy provided to manufacturing states in his report, even though it is not included in the charter of the committee, the official said. The proposed indirect tax reform will replace existing levies such as excise duty, service tax and value-added tax. The government was unable to get the Constitution amendment bill for GST passed in Rajya Sabha in the previous session of Parliament, which was a washout.

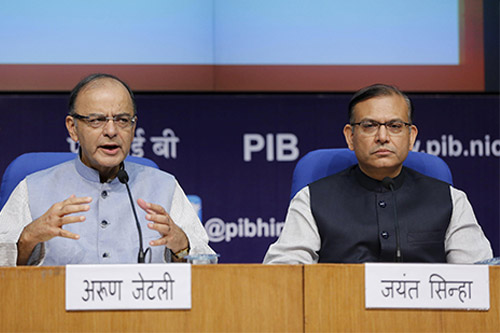

A report by the National Institute of Public Finance and Policy had earlier suggested a revenue neutral rate of 27 per cent, which was considered to be high by the government. In May, finance minister Arun Jaitley had said that the rate will be “much more diluted” than the suggested 27 per cent. The government having proposed exclusion of alcohol and petroleum from the ambit of GST is not keen on keeping the rate too high. The NIPFP was then asked to rework the RNR and has submitted a revised report, which is currently under the consideration of the Empowered Committee.

The Congress in its dissent note to the Rajya Sabha select committee had asked for capping the GST rate at 18 per cent, higher than the 12 per cent (7 per cent for state GST and 5 per cent for central GST) suggested by the task force associated with the 13th Finance Commission.

Though the NDA government has consistently reiterated that GST will be implemented in 2016, the rollout is likely to miss the April 2016 deadline even if the Constitution amendment bill were to get passed in the upcoming Winter session of Parliament as it requires to be then ratified by half the states.

(This article is published in The Indian Express on 19 Nov, 2015)